So you launched your shiny SaaS product. Customers are buying. You’re golden! Right? No, this is just the beginning. You sold them software, now it’s time to provide the service.

Hyde Park Venture Partners has made 18 investments over the last two years, most with newly launched SaaS products. This is what we’ve learned:

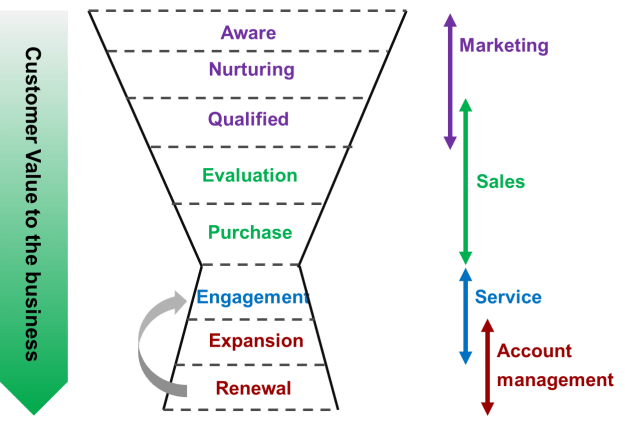

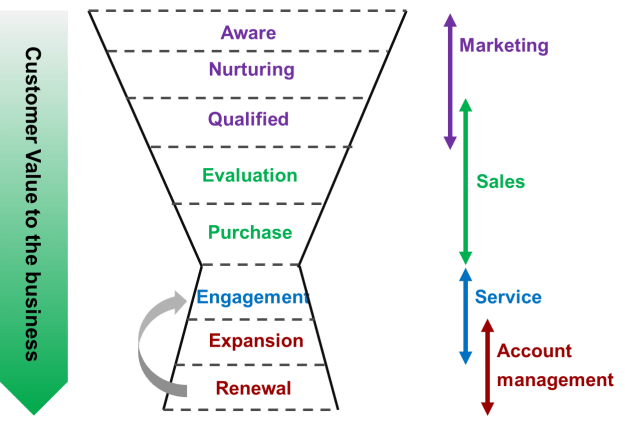

If you Google “sales funnel image” you will get lots of narrowed funnels with last stage of“purchase” or “decision”. This is a catastrophic way of thinking for a startup… a startup’s sales process needs to tie to its delivery process. We investors are often guilty of pushing sales without asking the question “then what?” Startups should think about what they do as a more complex pre-sales and post-sales funnel as follows.

Customers create value for your business (and you for them) with Engagement, Expansion and ultimately Renewal. Purchase is only the beginning. How do you deliver this? Service and account management. Most startups forget about these functions in the beginning until their customers teach them the hard way… by churning. The grey arrow is meant to show that post sales customer value creation is a cyclical process. The more customers engage, the more they expand, then renew and continue to engage. Awesome.

Most of our seed, and some of our Series A investments are still in the “founder sales” stage where founders are doing most of the selling to further advance product/market fit and define a process that they can hire sales people into. There should also be a “founder service” stage where one or two founders (Churn Czar) is laser focused on post sales engagement, expansion and renewal so that this process too can be codified and repeated… and most importantly, the customer base you’ve invested in, maintained.

In this stage, Churn is your arch enemy. Churn is defined in a number of ways. Common definitions are:

Customer # churn:

# of customers in a month/ total # customers

Customer $ churn:

$ of MRR lost in a month/ total MRR

OR

($ of MRR lost in a month – $ of MRR expanded within retained customer base)/total MRR

Each of these can also be defined per quarter or per month. I don’t like the last definition of $ churn (also called net $ churn) because it can hide problems…. a clever way of making things look good for fundraising… not a good operational metric. It’s GREAT if you are expanding MRR within your retained customer base, but losing MRR within your churned customer base is still an issue to address. Watch loss and expansion separately.

Use renewal rate as your leading indicator when you have contracts.

For an early stage startup, churn (especially net churn) is not a good early warning sign if you have customers under contract for longer than a month, say a year. Under these circumstances you may not have any retention feedback from customers until an entire year of selling (and service!) has passed. Then in the 13th month as contracts start coming due, even a renewal rate of only 60% can falsely seem okay in terms of churn. Example: let’s say your new SaaS business sells 10 contracts a month at $5K a month and signs 1 year contracts. It sells at this rate for 12 month, 1/3 of the contracts double by the end of the year, so now the business is doing $800K in MRR = 10*5K*12+ (10*5K*12)/3. Nice! Now in the 13th month, 10 contracts come up for renewal, and only 6 renew. Meanwhile, 5 more contracts double. Your monthly net $ churn is ((4*5k) lost – (5*5K) growth)/800K = -0.625%. You show this to your board and you like like a freakin’ genius! Negative churn! But this masks that your renewal was only 60%… AKA your loss rate is 40%. That means 4 of 10 customer ditched you when they had the chance…. scary.

OK, so that’s how you measure the problem, but how do you get ahead of it?

There are three core reasons behind poor renewal rates and churn:

1. Selling wrong product to right (or wrong) people: This is a product/market fit problem. Read this from @mikekarnj and pivot.

2. Selling right product to wrong people: This usually means you’re selling to two or more segments – in B2B SaaS, say businesses with <50 people and businesses with 50-250 people – one is not sticking. Disaggregating churn and renewal by customer segment will help you find where the problem is after the fact, but you can see it in advance by disaggregating engagement metrics (see below) by segment. Note that this problem and example are VERY common in B2B SaaS. The belief that SaaS would emancipate the elusive and huge SMB segment for profitable software penetration hasn’t worked out for a lot of startups. SMBs are costly to find and hard to keep sticky. Tough CAC/LTV economics. Medium sized businesses, however, tend to work out better

3. Selling right product to right people but not effectively managing post-sale service:

In this situation, there is product/market/segment fit, but you’re not getting your product to stick because you forgot about the service.

Watch the right engagement metrics:

You can’t know or fix what you don’t measure. Real time engagement monitoring is critical in any SaaS business. Depending on your business, monitor:

- Logins (almost all business)

- Files uploaded (think Dropbox)

- Profiles created (think CRM)

- Users added per account

- Etc….

Don’t fool yourself with cumulative numbers. Watch metrics per period and per customer to get a real understanding of what’s happening. And watch them every day on a big screen in your office like our friends @farmlogs. Monthly isn’t enough – you’ll be 30 days late in figuring out a feature release issue or customer problem. Then don’t stop with aggregate numbers. Aggregate numbers are a great way to monitor your startup’s overall health, but not specific customer health.

Remember that churn and customer loss outcomes are not won or lost in aggregate! It’s hand-to-hand combat.

To this end, have another big screen that highlights at-risk customers. Define parameters to surface customers for that board. Some flags might be:

- Hasn’t logged in for X days

- Uploaded files are dropping or falling below Y threshold per week

- User base within the company is declining

- Etc… all depends on the business

Geckoboard, Panic Board, IFTTT and Zapier, among others, have made this type of monitoring so easy. You don’t even need a precious dev to do it.

Have a service plan/organization

Don’t expect your customers to contact you with problems. They might just churn first! The purpose of the metric monitoring above is for YOU to identify the problems first and reach out proactively. Call and e-mail your customers and see what’s going on. Offer training (scalable video modules or 1:1 depending on price point). Help them get value out of the product.

Your startup resources are constrained, but it’s time to start thinking about the people who will monitor and re-engage customers when there’s a problem…. not to mention upsell to them. This function falls to a founder at first (your Churn Czar). Eventually it’s an account management and a service organization.

If you sell low priced SaaS, outreach and engagement marketing can and should be automated. E-mail new customers content on how best to use their new tool. Customize ongoing e-mail outreach to specific customer use/needs, and offer webinars. Flag customers who haven’t engaged at all, and call them, no matter what the price point. They are about to churn!

If you’re selling high priced SaaS, call new customers every week in the beginning and thereafter monthly. Let them know who their account manager or service rep is, offer support on workflow integration, training, and data migration. Use these convos to upsell and renew.

As account management matures, begin compensating reps on up-sells and renewals. Good median benchmarks are 2% commissions for renewals and 6% commissions for up-sells. Note that it is very hard to have sales and account management in the same department… or at least to have the same reps doing both. Inevitably, you will get the incentive balance between commissions on new and renewal/upsell wrong and suddenly you’ll be doing all new sales (and ignoring your existing customers) or all upsells.

When are customer service and account management the same thing? When your product users and deciders are the same people. If you have a hierarchical sale, however, with users at the bottom of the org and deciders at the top, you likely need to keep customer service and account management separate.

Some other business model watchouts that lead to higher churn

We’ve seen a few business model flaws that naturally lead to churn. Price-per-seat and metered models tend to increase the likelihood of churn. Your customers will try to limit users and use to avoid cost preventing organization workflow integration and adoption – the exact opposite of what you want. This leads to churn when one of the few users leaves or someone who doesn’t use the product finds underwhelming support in a budget review.

We prefer the big tent approach. Price your product based on general organization size or revenue under management and then encourage use across the organization… the more users the better! This gets you embedded and increases the likelihood of renewal even if your original champion moves on. Once deeply integrated and “stuck” you will be in a good position to negotiate a higher price in the next renewal cycle when you point to all the internal user growth!

CaSaaStrophe avoided. I hope.

Like this:

Like Loading...